Applying for Child Benefit in the UK isn’t just about ticking boxes and dealing with paperwork; it’s a doorway to ensuring your little ones have the support they need. In this friendly guide, we’ll walk you through the process step-by-step. Whether you’re welcoming your first child or adding to your bustling family, this article is your first step towards a little extra peace of mind in the beautiful chaos of parenting. Let’s dive in!

What Is Child Benefit?

Child Benefit is a UK financial assistance program for parents and guardians. It is aimed at helping parents cover part of the costs involved in raising children. Some of the expenses that can be covered with this money are food, clothing, education, and healthcare.

Can Anyone Apply for Child Benefits?

Almost anyone responsible for a child under 16 (or under 20 if they remain in approved education or training) can apply for Child Benefit. This includes parents, guardians, or anyone else who is the main caregiver. Your kids can be biological or:

- Foster children (only if the council isn’t paying anything towards the care of the child)

- Adopted (you do not have to wait until the adoption process is complete to fill out the claim form)

As child benefit eligibility depends on your immigration status, you must be a UK citizen or fall into one of these categories:

- Be a spouse/civil partner, child/grandchild below 21, or a parent/grandparent dependent on a family member of an EEA or Swiss national with the right to reside in the UK

- Have settled status under the EU Settlement Scheme

- Have pre-settled status under the EU Settlement Scheme (only if you have work, are looking for work, or have enough resources to support yourself financially).

If you are taking care of someone else’s child, living abroad, or looking after a sick child in a hospital, the rules might change slightly. You can find out more about that here.

Please note that we said “almost anyone” can start a child benefit claim as people on visas with “No Recourse to Public Funds” (such as, the Spouse Visa) cannot apply for Child Benefits.

How Much Is Child Benefit?

The amount of child benefit you get is based on factors like the number of children in the household and the parents’ incomes. The child benefit cap is fixed to a set amount, so you do not need an online benefits calculator to figure out how much you will receive.

From 6 April 2024, these are the child benefit rates:

| Child | Weekly Amount |

|---|---|

| First or only child | £25.60 |

| Additional children | £16.95 |

What Happens If You Separate From Your Partner?

Only one person per child can claim Child Benefit. If you and your partner split up, you must decide who will be responsible for the child. The person with custody of the child will receive the money every 4 weeks or every week if they are single parents and this has been agreed with HMRC.

When you have two children and both have custody of one child, you will get paid £25.60 each. But if you have more than one child under your care, every one of them (other than the first child) will receive the 2 child benefit cap of £16.95 per week.

If two families join together, the eldest child in the new family gets the £25.60 rate and any other children who are eligible get the £16.95 rate.

It’s important for those eligible to claim Child Benefit even if they opt not to receive the payments, as they are turned into National Insurance Credits. These protect your State Pension and ensure there are no gaps in your National Insurance Contributions when you are not working and do not earn enough to pay them.

What Other Changes to Child Benefit 2024 Should I Know About?

From 6 April 2024, if you or your partner earn over the £60,000 a year net income threshold, you might be subject to the High Income Child Benefit Charge. This means you’ll be charged 1% of your Child Benefit for every £200 of income that exceeds £60,000.

Previously, child benefit was taken away entirely when one parent earned more than £60,000. The income threshold to lose your right to Child Benefit has now been increased to £80,000. The plan is that by April 2026, child benefit claims would be based on total household income and not the highest earner’s wage.

How Will You Receive Your Child Benefit Payments?

You will get the child allowance paid straight into your bank, building society or credit union account. You can’t use a Post Office card account and a Nationwide cashbuilder account (sort code 07 00 30) in someone else’s name.

Child benefits payments are usually made monthly on a Monday or Tuesday. However, HMRC makes exceptions for single parents and beneficiaries of other state benefits such as Universal Credit. In this case, they can opt to receive the money weekly.

How To Apply for Child Benefit

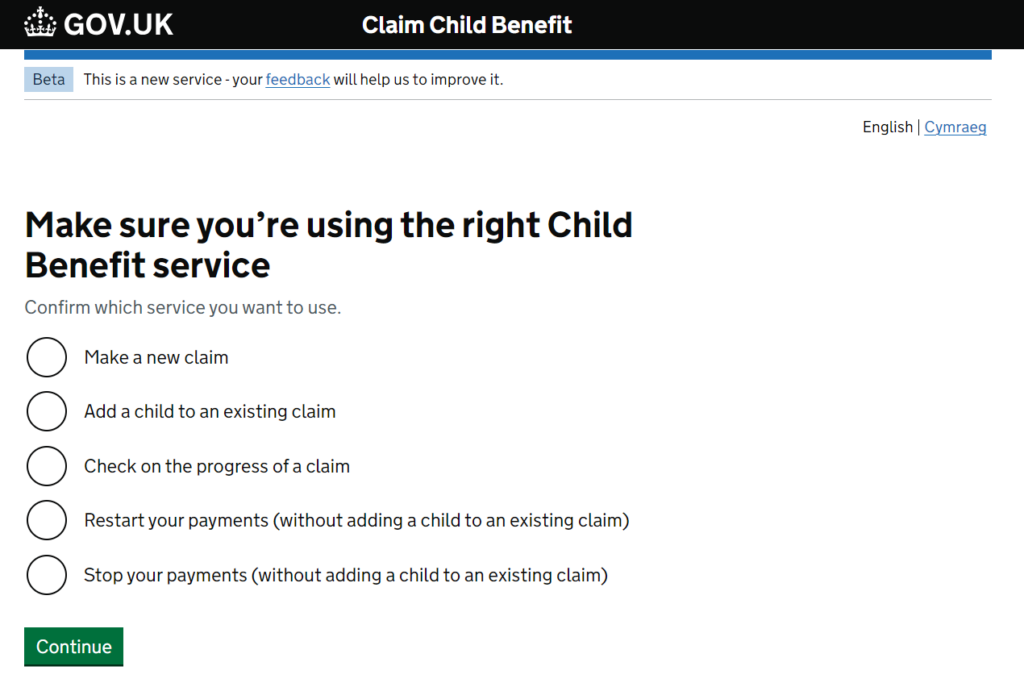

The easiest way to claim child benefits is online. Fill out the online form by choosing the correct options. You can make a new claim, add child to child benefit in an existing claim, check the progress of a claim, restart payments, or stop them altogether.

Alternatively, you can apply by post if you can’t apply online. You must fill out the Child Benefit form CH2 below and send it by post to the Child Benefit Office (the address is on the form). Complete the form with the correct information.

If you wish to add an additional child by post, you must complete this form instead.

You can use the official HMRC app to manage your Child Benefit claim. If you have any questions about a claim or the answer to your question isn’t online, you can phone the child benefit contact number at 0300 200 3100.

What Documents Do I Need?

You must provide evidence to support your claim. Here’s what you may need to have at hand or attach to the application depending on your situation:

- National Insurance Number

- Proof of identity

- Birth certificate

- Adoption certificate

- Passport or travel document used to enter the UK (if the child was born outside the UK)

- Income pay slips or bank statements

- Bank account number

How Long Does Child Benefit Take To Process?

It can take up to 16 weeks to process your claim. The more accurate and complete your application form is, the less time it’ll take to process. You’ll receive a response to your claim by post.

More Cash for Families

Applying for Child Benefit in the UK is a straightforward process that can greatly benefit families with children below 16 (or 20 under approved education programs). The allowance consists of a weekly payment of £25.60 for your first child and £16.95 for subsequent children. You can use Child Benefit payments to assist you with covering everyday expenses.

Complete the Child Benefit form, get the required documentation, and submit it together with the form online or by post to ensure you receive this valuable support. Remember to apply as soon as possible to avoid missing out on payments.

FAQ

When Can You Make a Child Benefit Claim?

You can claim Child Benefit 48 hours after you’ve registered the birth of your child or once a child comes to live with you. You can backdate your claim up to 3 months.

What Is the Income Threshold for Child Benefit?

An income threshold is a set income limit. If you earn more than this limit, it can affect your eligibility for benefits. From 6 April 2024, the net income threshold for child Benefit is £60,000 a year. This is your total taxable income before any deductions or allowances.

What Is a Benefit Cap?

Any Child Benefit payments you get will count towards the benefit cap. This is a limit on the total amount of welfare benefits that a household can receive. For those living inside Greater London, the benefit cap in 2024 stands at £2,110.25 for single parents or couples. Whereas for those couples or single parents outside Greater London, it stands at £1,835.

Is Child Tax Credit the Same as Child Benefit?

No, Child Tax Credit is not the same as Child Benefit. Child Tax Credit is a means-tested payment for families with children to help with everyday costs. Whereas, Child Benefit is a universal payment available to all families with children, regardless of income.

When Does Child Benefit Stop?

The government will keep sending you the Children Allowance until your child turns 16 or you choose to exit the scheme. In some cases, you may continue receiving the money if your child is below 20 but under approved education or training.