Life is like a box of chocolates; you never know what you’re gonna get. Unfortunately, sometimes what you get is an unexpected spell of illness. That’s where Statutory Sick Pay (SSP) steps in. Would you like to learn more about how SSP works in the UK? You’ve come to the right place! We’ll tell you what SSP is, who qualifies, and how to start receiving your weekly payments if you fall ill.

- What Is Statutory Sick Pay?

- How Does SPP Work?

- Who Can Apply for Statutory Sick Pay?

- When Should I Apply for Statutory Sick Pay?

- How Do I Claim Statutory Sick Pay?

- How Much Is Statutory Sick Pay?

- What Happens When Sick Pay Runs Out?

- How Long Does It Take To Start Receiving SPP?

- Peace of Mind While You Recover

- FAQ

What Is Statutory Sick Pay?

Statutory Sick Pay (SSP) is a vital support for employees unable to work due to illness. In the UK, it’s a legal requirement for employers to provide SSP to their employees when they’re ill.

How Does SPP Work?

You can start receiving SSP from the fourth day you’re off sick, which means you must have been ill for at least 3 consecutive days (including non-working days) to be eligible for SPP.

A day can only be considered a ‘sick day’ if you don’t work. If you work for even a minute before leaving due to illness, that day does not qualify as a sick day. For shifts that span over to the next day, if you become ill during it or after it has finished, the following day will count as a sick day.

Employees have the right to annual leave even when absent from work due to illness. This means that no matter how long you are off sick, you will still earn your annual leave during this time. You may choose to use your accumulated annual leave during your period of sick leave to receive your full salary rather than a lower sick pay. But your employer cannot force you into this.

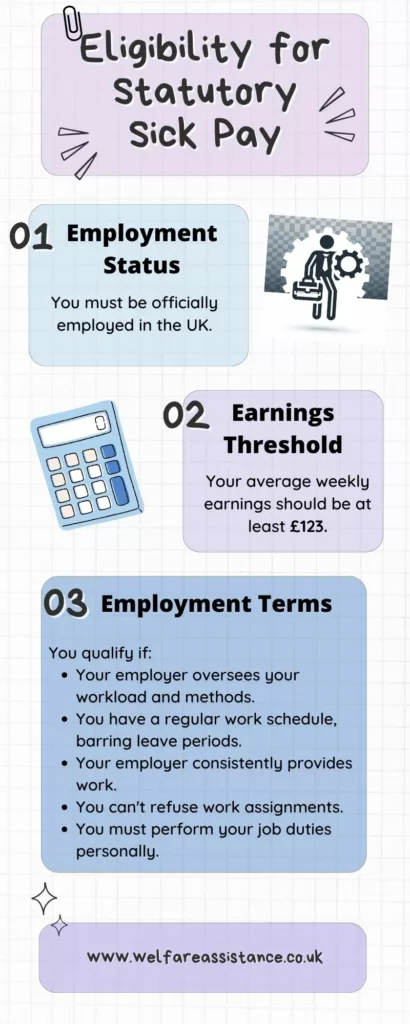

Who Can Apply for Statutory Sick Pay?

To qualify for Statutory Sick Pay, you must be recognized as an employee in the UK and earn a minimum of £123 per week. Agency workers can get SPP too. If you are unsure as to whether you are eligible for SSP, here’s what you need to know:

Please note that those who have already received the maximum amount of SSP (28 weeks) or are getting Statutory Maternity Pay don’t qualify for sick pay.

When Should I Apply for Statutory Sick Pay?

Timing is key when applying for Statutory Sick Pay (SSP). If you’re feeling under the weather and unable to work, it’s important to act swiftly. The ideal time to apply is from the fourth day of your illness – this counts weekends too.

How Do I Claim Statutory Sick Pay?

The first step is to inform your employer about your illness. You can apply for Statutory Sick Pay (SSP) by filling in the SPP online form. This isn’t just a simple notification; it’s a crucial part of your SSP application. You must do this in line with the deadlines outlined in your employment contract or within the first seven days of your illness if your contract doesn’t specify a timeframe.

What Documents Do I Need To Apply for Sick Pay?

To request sick leave, you must provide the following:

- National Insurance Number (NIN)

- Identification details

- Contact details

- Proof of illness (a fit note) when you’re ill for more than 7 days

You can get a fit note (also called sick note) from your GP, hospital doctor, registered nurse, occupational therapist, pharmacist, or physiotherapist. It can be printed or digital.

How Much Is Statutory Sick Pay?

Understanding the amount of SSP is crucial to ensure your employer complies with the legal standards. In 2024, employers must pay a standard spp rate of £116.75 per week for up to 28 weeks. This rate is paid for ‘qualifying days’, which refers to the days the employee works, regardless of whether you are a full-time or part-time worker.

As with your regular salary, the SSP amount is directly deposited into your bank account. When you have more than one job, you can get sick pay from each employer. You can use this SSP calculator to calculate the rate you’ll get per day.

SSP is not paid for the first three working days (also known as ‘spp waiting days’) an employee is off sick, except under specific conditions. If you have been paid SSP within the last eight weeks and did not get paid for the first three sick days during that period, then statutory sick pay should be paid for these initial three days off.

What Happens When Sick Pay Runs Out?

If your illness persists beyond the 28-week threshold, your employer must issue an SSP1 form. This form, typically provided a week before the cessation of SSP, officially indicates the end of your SSP eligibility:

Unfortunately, SSP benefits do not extend beyond this 28-week period. So if you find yourself in need of further financial assistance post-SSP, there are additional social welfare options available, such as Employment and Support Allowance (ESA), Personal Independence Payment (PIP), or Universal Credit. These options offer support to those who either exceed the SSP duration or do not meet the criteria for SSP in the first place.

How Long Does It Take To Start Receiving SPP?

Once you apply for SSP, your employer should approve this request within seven working days, but it could take more, depending on the circumstances. Providing accurate details ascertains you have your request approved faster.

If you start feeling better, you should tell your employer immediately. Depending on what is indicated in your contract, you should use that channel to alert your boss of the changes.

Peace of Mind While You Recover

SSP provides essential financial support during sick leave, ensuring that employees recover without the added stress. To claim Statutory Sick Pay, you must fulfil the criteria and inform your employer as soon as possible within the time frame specified in your employment contract.

As a qualifying employee, you are entitled to £116.75 weekly spp payments for up to 28 weeks. As SSP is limited to 28 weeks, exploring other available welfare options after SSP ends is crucial for those needing extended support.

We hope you find the information provided here useful. If you think you are not getting the right amount of SSP, we suggest you talk to your employer or contact the HM Revenue and Customs (HMRC) enquiry line.

FAQ

Do you get taxed on statutory sick pay?

Yes, Tax and National Insurance will be deducted from your SPP payments.

How long do you have to work at a place before you get sick pay?

Generally, you may still qualify if you started your job recently and have not received 8 weeks’ pay yet. We suggest you ask your employer to find out more about this.

Can you get other benefits with SSP?

Eligibility for SSP might be affected if you are concurrently receiving other types of benefits. For example, those getting Statutory Maternity Pay don’t qualify for UK sick pay. Ensure you fulfil the requirements and check how your other benefits interact with SSP entitlement.